On March 9 2025 Bitcoin market experienced a major crypto crashing which reduced its value to below $82,000. The quick price drop transmitted intensive disruption through the cryptocurrency community about market steadiness and upcoming directions.

Bitcoin dropped steeply

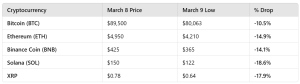

Bitcoin (BTC) and other virtual assets experienced a dramatic market downfall. It dropped steeply from its previous trading point of $85,000 to below $82,000 thus causing widespread panic throughout the industry. Major cryptocurrencies ETH, BNB, and SOL joined Bitcoin (BTC) with steep dives in their market values.

The unforeseen market plunge led to several unanswered queries about the origin of this quick price fall. The market adjustment or external elements caused this downfall. Crypto markets are predicting their next course of direction. The article explores all essential aspects of the collapse including its fundamental drivers and market disturbances alongside forecasts about future performance.

Key Factors Behind the Crypto Crashing

Crypto crashing often result from multiple factors, three major reasons stood out in the March 9, 2025 crash:

The White House Crypto Summit & Policy Shift

One of the biggest triggers was an executive order signed by former U.S. President Donald Trump during the White House Crypto Summit.

- The order aimed to create a Bitcoin strategic reserve for the U.S. government.

- However, instead of buying Bitcoin from the open market, the plan focused on accumulating BTC through asset seizures from criminal and civil cases.

- This disappointed investors, who were hoping for direct Bitcoin purchases by the U.S. government, similar to El Salvador’s strategy.

- Panic selling followed, leading to a sharp drop in BTC prices.

Global Economic Uncertainty & Rising Trade Tensions

The crypto crashing is also coincided with growing economic tensions between the U.S. and China.

- Tariff threats & supply chain disruptions: New trade tariffs on Chinese exports to the U.S. led to fears of a prolonged economic war.

- Stock market instability: Global stock markets, including the S&P 500 and NASDAQ, saw steep declines.

- Safe-haven shift: Investors moved capital into gold and U.S. bonds, reducing their exposure to risky assets like crypto.

📌 Market reaction

Historically, economic uncertainty has been a double-edged sword for Bitcoin—sometimes driving demand, but also triggering sell-offs when investors seek liquidity. This time, the latter scenario played out. (Source)

Predicted Market Correction & Liquidity Issues

Prominent crypto analyst and BitMEX co-founder Arthur Hayes had previously warned about a market correction in March 2025.

- Hayes argued that the crypto rally in late 2024 and early 2025 was fueled by excess liquidity in the U.S. dollar market.

- He predicted that once liquidity tightened, crypto markets would experience a sharp correction.

- As U.S. interest rates remained high, institutional investors withdrew capital from riskier markets, leading to lower trading volume and more volatility.

📌 Market reaction

When Bitcoin started falling, stop-loss triggers and liquidations accelerated the downturn, making the crash even more severe. (Source)

Current Market Conditions

Bitcoin has shown some stability after the crash but remains volatile.

📌 Current Market Snapshot (March 10, 2025):

- Bitcoin (BTC): $82,595 (-3.17% in 24h)

- Ethereum (ETH): $4,350 (-4.2%)

- Total Crypto Market Cap: $1.85 trillion (-8.6% from pre-crash levels)

- Liquidations in Last 24 Hours: $4.3 billion

- Ethereum ETFs are expected to be approved in mid-2025, bringing fresh capital into crypto.

- Major companies like Tesla and Apple are rumored to be working on blockchain-based payment systems.

- Bitcoin’s halving event in April 2024 had already created a supply shock, which could drive prices higher once market sentiment stabilizes.

Investors Current Sentiment:

- The Fear & Greed Index dropped from 72 (“Greed”) to 43 (“Fear”), reflecting increasing uncertainty.

- Altcoins remain under pressure, while stablecoins like USDT and USDC saw an increase in inflows, indicating a defensive shift.

What’s Next? Can Crypto Recover?

The big question now: Will Bitcoin and the crypto market bounce back?

Here are three possible scenarios:

Bullish Scenario: A Quick Rebound

- If institutions buy the dip, Bitcoin could regain momentum above $85,000.

- Positive regulatory developments in the EU and Asia might offset negative sentiment from the U.S.

- Upcoming Bitcoin halving in April 2025 could provide a long-term bullish catalyst.

B. Bearish Scenario: More Pain Ahead

- If selling pressure continues, Bitcoin could drop to $75,000 or lower.

- Further economic uncertainty or a global recession could reduce liquidity, affecting crypto investments.

- U.S. regulators might introduce stricter rules, leading to more uncertainty.

C. Neutral Scenario: Market Consolidation

- Bitcoin could stabilize between $80,000 and $85,000 in the short term.

- Investors may adopt a wait-and-see approach, delaying big moves until more clarity emerges.

Final Thoughts:

The March 9, 2025, crash reminds us that crypto remains a highly volatile market. While long-term prospects for Bitcoin and blockchain technology remain strong, short-term risks must not be ignored.

🔹 Key

- Diversification is key – Don’t put all your capital into crypto.

- Monitor global events – Macroeconomic shifts impact digital assets.

- Beware of excessive leverage – Many traders were liquidated due to high-risk positions.

- Long-term conviction wins – Short-term volatility should not shake long-term belief in crypto’s future.

As the market recovers, smart investors will use this opportunity to reassess their strategies and position themselves for the next bull run.